OBJECTIVE

Determine

probable outcomes.

DESCRIPTION

In deterministic models we predict

events in a simple linear system and we assume that the initial conditions do not

change. Besides, the same initial conditions will give the same results. However,

the world is more complicated and events are usually determined by a complex

interrelation of different variables, some of which are difficult or almost

impossible to estimate. Monte Carlo simulations solve this problem by using

probability distributions for each input variable and then running several

simulations to produce probable outcomes. We can say that this model allows the

prediction of an outcome without conducting many expensive experiments.

The steps

for performing a Monte Carlo simulation are:

- - Define the mathematical formula for the outcome;

- - Identify the probability distributions of the input variables and define their parameters;

- - Run the simulations;

- - Analyze and optimize.

Monte Carlo Simulation Output

Input and Output Variables

The first

step in a Monte Carlos simulation is to define the output, that is to say to identify

the variable that we want to predict, for example “profits.” Then we should

identify the input variables on which “profits” depend. Some of them may be

certain; for example, we can have a fixed cost with a specific value, but

usually they are uncertain. For each of the uncertain variables, we need to identify

a specific probability distribution to use for the simulation. Examples of

distribution are:

- - Discrete distribution: we define the probability of a finite number of values;

- - Uniform distribution: each variable value has similar probabilities (for example, when throwing a die, each number has a 1/6 probability);

- - Bernoulli distribution: we have only two alternative and exclusive outcomes (0 or 1);

- - Normal distribution: the central values are the most probable ones (defined by the mean and standard deviation);

- - Triangular distribution: we have a most probable value and a lower and an upper limit;

- - Other distributions: exponential, logarithmic, binomial, beta, etc.

Having identified

the distribution, we can use a chi-square test (see 48. CHI-SQUARE) to check whether the data fit the chosen

distribution. An alternative would be to conduct a Korm–Smirnov test.

In this

phase we also write the mathematical formula by which the outcome is defined,

for example:

Profits = (Price – Variable cost) * Units –

Fixed Costs

The

simulation is then performed repeating the input variables (with each specific

probability distribution) hundreds or thousands of times to obtain a

distribution of probable results.

Analysis and Optimization

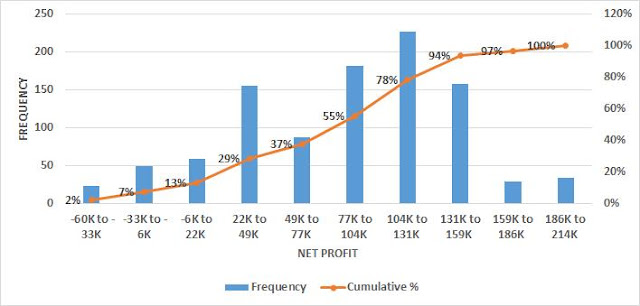

Once the

range of probable results has been obtained, depending on the objective, we use

indicators such as the minimum value, maximum value, average, standard

deviation, and so on. In general we usually compare:

- - Expected value: the mean of all the outputs with its confidence intervals;

- - Risk: in the proposed example it is the probability of negative profits (% of outputs < 0), but we can also choose a specific value.

It is also

possible to compare different simulations with different input variables’

values or distributions. To compare them, we should calculate the confidence

intervals of both expected values and risks. If the range between the

confidence intervals does not overlap, we can infer that one scenario is better

or worse than the other one.

If the objective

is to use the results for a business plan or in risk analysis, we can stop

here, but if we want to optimize the outcomes, a sensitivity analysis is

needed. In this kind of analysis, we measure the “importance” of each input and

may decide to act on the most influential ones. Usually the correlation

coefficient between each input and the output is used, but different techniques

can be adopted.

TEMPLATE

Discount code -40%: BLOG_ANALYTICS_MODELS

No comments:

Post a Comment