OBJECTIVE

Estimate the lifetime

value of a customer or group of customers.

DESCRIPTION

Customer lifetime value is an indicator that

represents the net present value of a customer based on the estimated future revenues

and costs. The main components of this calculation are:

- - Average purchase margin (revenue – costs);

- - Frequency of purchase;

- - Marketing costs;

- - Discount rate or cost of capital.

There are several ways

to calculate it, and different formulas have been proposed. The most difficult

part is to estimate customers’ retention (in contractual settings) or

repetition and to estimate the monetary amount that a customer will spend in

the future. It is important to remember that CLV is about the future and not

the past, which is why using past data of a customer is not the best method for

calculating CLV. A good practice is to segment customers and estimate the

retention and spending patterns based on similar customers. Then, the following

formula can be applied:

- CLV = customer lifetime value

- MC = yearly marginal contribution, that is to say the total purchase revenue in a year minus the unit costs of production and marketing

- R = retention rate (yearly)

- D = discount rate

- CA = cost of acquisition (one-time cost spent by the company to reach a new customer)

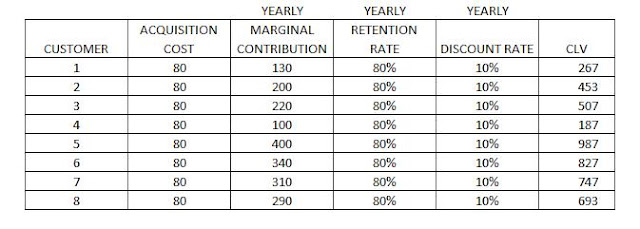

Customer Lifetime Value of Different Customers

The discount rate can

be the average cost of capital for the company or the related industry, and it

is used to depreciate the value of future benefits to estimate what they are worth

today. With this formula we

can estimate the CLV of a single customer or a segment of customers. In the

case of estimating it at the individual level, we should use the retention rate

(r) of similar customers, for example customers who buy similar products, or more

sophisticated techniques, for example cluster analysis.

When we define the

value of a customer or a group of customers, we can make decisions concerning

the level of attention, the investment in marketing and retention costs, or the

amount that we can spend (cost of acquisition) to attract customers with a

similar CLV.

Even though it is

quite difficult to estimate, we have to consider that the CLV formula does not take

into account the value generated by referrals. Although some formulas have been

proposed,[1]

this calculation is seldom used due to the lack of information. In fact, to

calculate the customer referral value, we need information about the advocates

and the referred customers, and for the latter we should be able to distinguish

those who would have made the purchase anyway (without the referral). As a

proxy we can use the NPS (see 29.

NET PROMOTER SCORE® (NPS®)) combined with other information from surveys,

such as asking whether a customer has been referred and how much the referral has

affected the purchase.

The market’s historical

data is the main source of information (at the individual level, usually from

CRM systems), but it can be enriched with survey data, for example concerning the

likelihood of repeating the purchase or recommending the product.

TEMPLATE

No comments:

Post a Comment